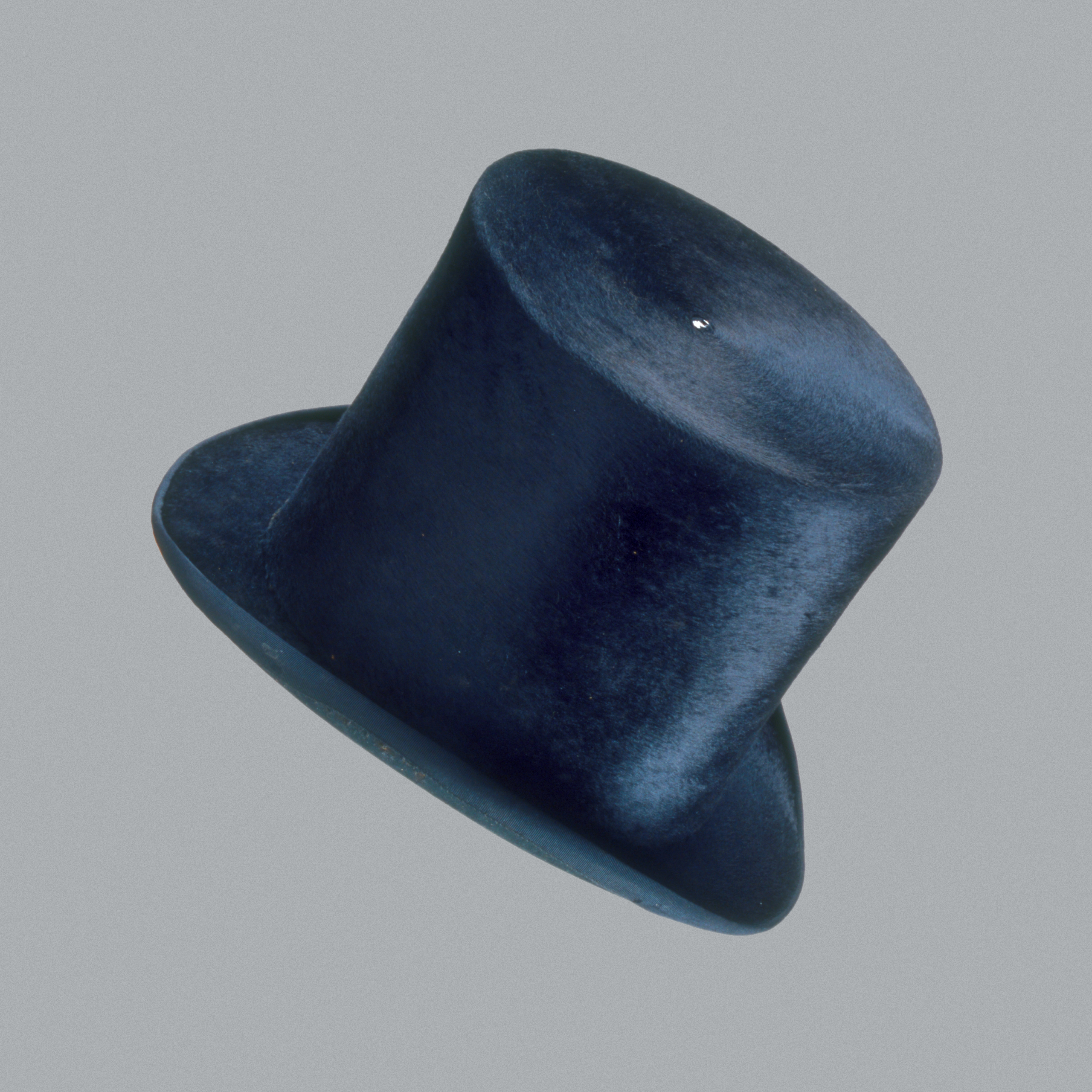

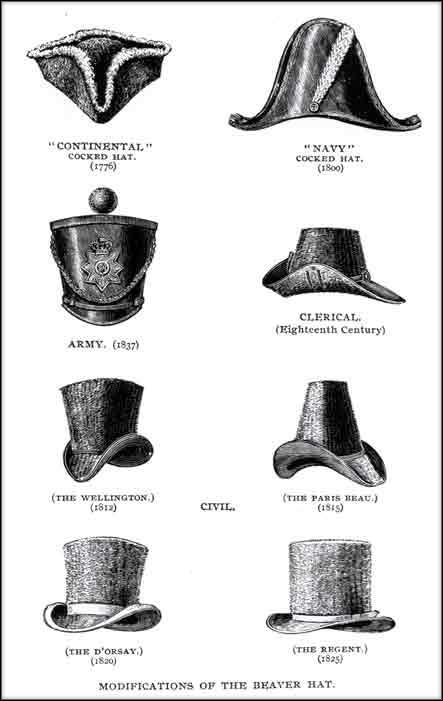

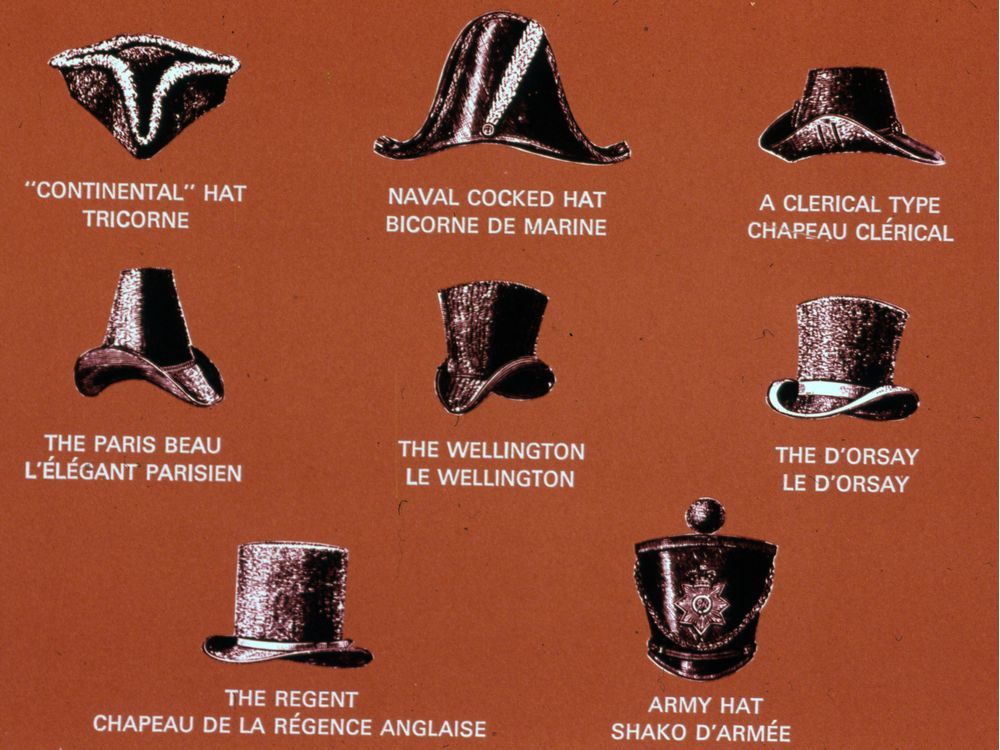

Different styles of hats made from beaver felt. Figure copywritten by... | Download Scientific Diagram

A custom square top made with 100X pure beaver fur felt in the color Pecan. Thank you for the order. #patersonhatcompany… | Instagram

Amazon.com: Agnoulita Caruso | Custom Handmade Beaver Fur Felt Fedora Hat | Made to Order : Clothing, Shoes & Jewelry