Amazon.com : 14 Inch Short Black Headband Wig Human Hair Half Wigs for Black Women Glueless None Lace Front Wigs 150% Density Straight Wig with Three Headbands : Beauty & Personal Care

Amazon.com : G&T Headband Wigs for Black Women Red Straight Glueless Wigs Heat Resistant Synthetic Wig for Daily Party Use (24 inch) : Beauty & Personal Care

Amazon.com : G&T Headband Wig for Women Black Straight Synthetic Headband Wig Glueless Heat Resistant Natutal Looking for Daily Party Use 24 Inch : Beauty & Personal Care

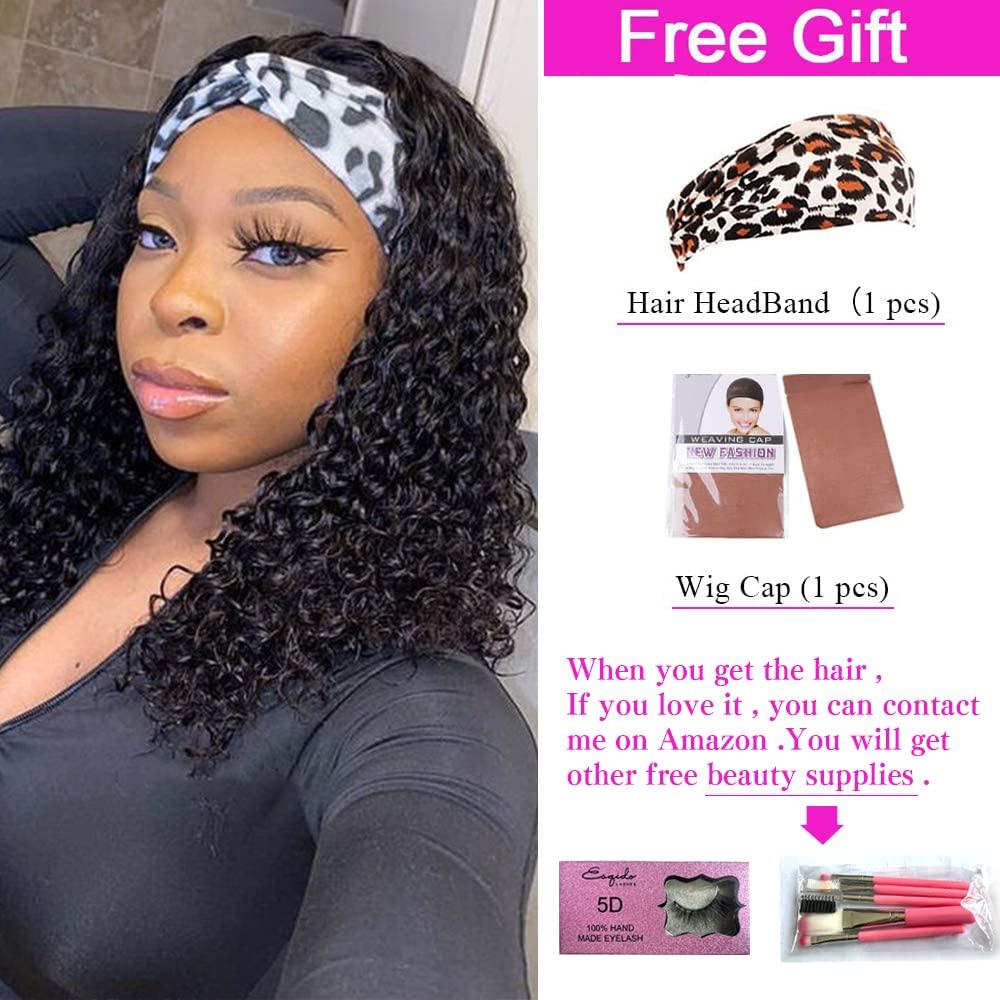

HeadBand Wig Curly Human Hair Wig None Lace Front Wigs for Black Women Deep Wave Machine Made Wigs Natural Color 150% Density (12inch) 12 Inch Natural Color Curly Headband Wigs

Do not sleep on these headband wigs! Although my hair is super short I was able to style this wig while making it look realistic. Watch the full detailed... | By Roxy

Beauhair Headband Wigs Human Hair Straight Headband Wigs Headband for Black Women None Lace Front Wigs Machine Made Wigs 180% Density No GLUE Easy Wear 14 Inch Natural Color - Walmart.com